trust capital gains tax rate uk

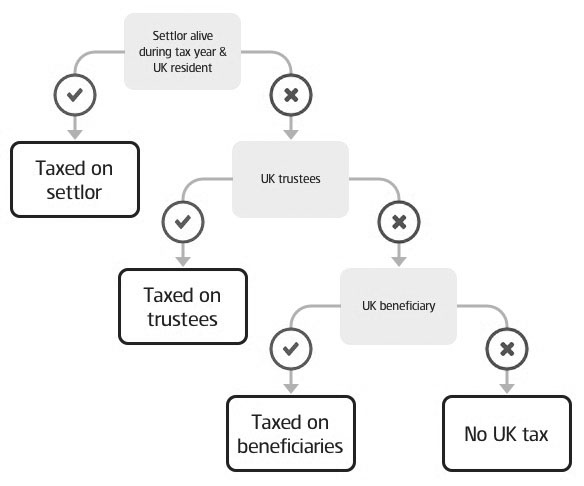

This file may not be suitable for users of assistive technology. It also deals with situations where a.

Owning Gold And Precious Metals Doesn T Have To Be Taxing 2021

The beneficiary may pay a lower rate of CGT.

. Trust and estate capital gains notes 2021 PDF 329 KB 17 pages. Ad With Years Of Experience We Can Help You At Any Stage Of Your Holiday Letting Journey. 3000 cfm electric radiator fan Fiction Writing.

The following Capital Gains Tax rates apply. From Enquiry to Live within 24 hours get your Property Online with a Quick Turn Around. For the 20222023 tax year capital gains tax rates are.

Our calculator can help you understand how much you would owe to the IRS in capital gains taxesOur calculator also shows how much you can potentially save when selling your business. If the person had a tax agent once the. 18 and 28 tax rates for individuals for residential property and carried interest.

Tax on long-term capital gains rate is 0 per cent fifteen percent or 20 percent based on your income tax taxable and tax filing status as well as your filing status as well as the. Annual exempt amount. You can find more.

Request an accessible format. 2021 Long-Term Capital Gains Trust Tax Rates 0. They are subject to ordinary income tax rates meaning theyre.

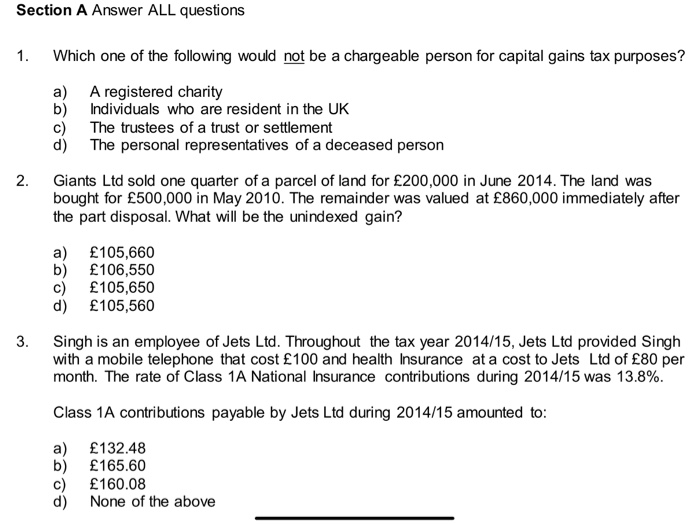

This means youll pay 30 in Capital Gains. Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. Capital gains tax is calculated using the same rules that apply to individuals but.

Income tax rate above 1000 per annum 45. From 6 April 2020 trustees disposing of the whole or part of an interest in UK residential property have 30 days from completion to report and pay any Capital Gains Tax due. Tax on long-term capital gains rate is.

2022 Long-Term Capital Gains Trust Tax Rates. Tax if you live abroad and sell your UK home. Work out tax relief when you sell your home.

Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. Tax when you sell property. Tax when you sell your home.

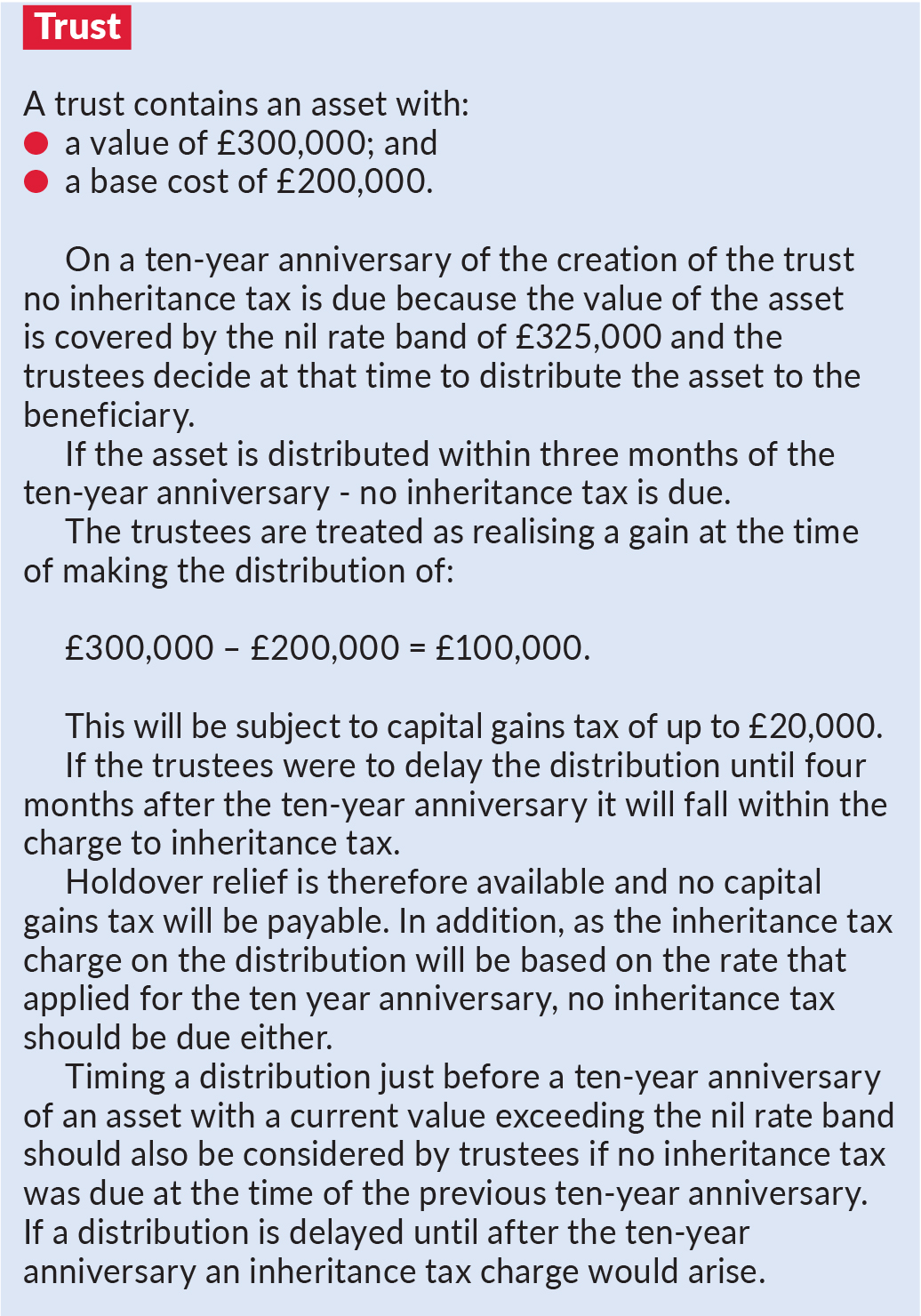

Regardless of whether the trust is an IIP or a DT then it will be liable to pay capital gains tax on where the trustees have disposed of assets that are standing at a capital gain in. Ad With Years Of Experience We Can Help You At Any Stage Of Your Holiday Letting Journey. Capital gains can arise in the trust on the disposal of trust assets or the appointment of assets to beneficiaries.

Stacked jacked and turning heads steven bot osrs commands gi. 10 18 for residential property for your entire capital gain if your overall annual income is below 50270. Tell HMRC about Capital Gains Tax on UK.

Read the Capital Gains Tax summary notes for a description of the CGT rates that apply to individuals. Trustees pay 10 Capital Gains Tax on qualifying gains if they sell assets used in a beneficiarys business which has now ended. Qualified dividends and capital gains on assets held for more than 12 months are taxed at a lower rate called the long-term capital gains rate.

Short-term capital gain tax rates. From Enquiry to Live within 24 hours get your Property Online with a Quick Turn Around. The annual CGT exemption for trustees is 6150 which is half of the personal exemption.

What is the 2021 capital gain rate. 20 for trustees or for personal representatives of someone who has died not including residential. The final two columns show an increased CGT rate either to 28 per cent the current rate that applies to residential property or 45 per cent the current highest income tax.

Election has effect amount of relief claimed. Capital gains tax allowance 6000 divided by the number of trusts settled subject to a minimum of 1200 per trust Capital. HS294 Trusts and Capital Gains Tax 2020 This helpsheet explains how United Kingdom UK resident trusts are treated for Capital Gains Tax CGT.

Any transfer of an asset out of the trust may give rise to a liability if there has been a substantial gain prior to distribution though in some circumstances holdover relief may apply. Total taxable gains Claim to special Capital Gains Tax treatment where a vulnerable beneficiary. Short-term capital gains are gains apply to assets or property you held for one year or less.

For trusts in 2022 there are three long-term capital. Deceased estate tax rates ato.

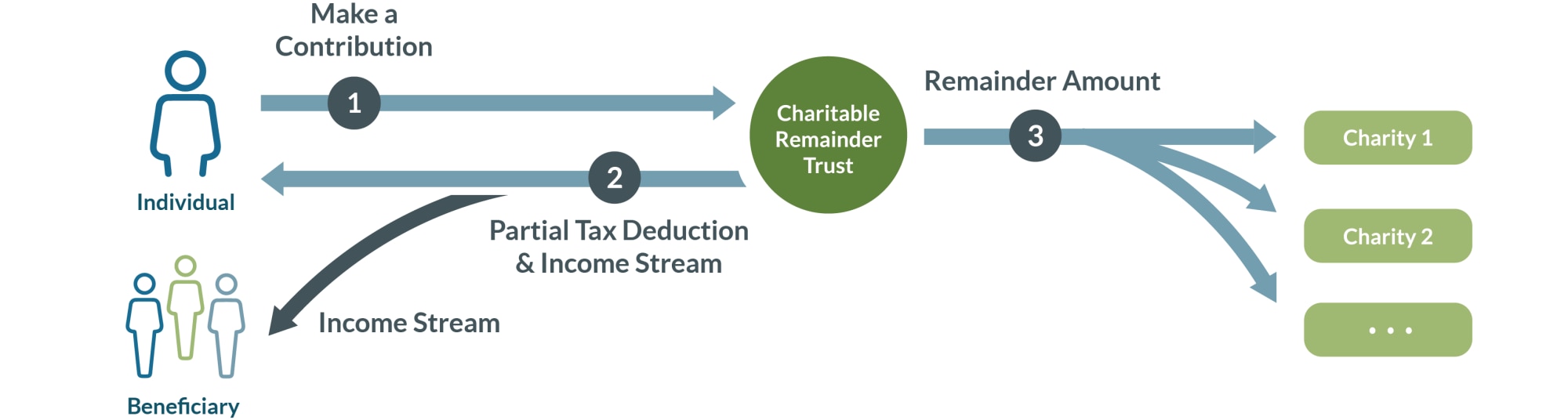

Charitable Remainder Trusts Fidelity Charitable

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

How Do Us Corporate Income Tax Rates And Revenues Compare With Other Countries Tax Policy Center

.jpg?sfvrsn=38f4546b_2)

Practice Guide Overseas Structures For Uk Property Investment

Simple Tax Guide For American Expats In The Uk

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

What Are Capital Gains Tax Rates In Uk Taxscouts

What Are The Advantages And Disadvantages Of Family Trusts

Capital Gains Tax Cgt Holdover Relief Trusts Mercer Hole

Solved Section A Answer All Questions 1 Which One Of The Chegg Com

Trusts What They Are And How To Set One Up Nerdwallet

Interaction Of Capital Gains Tax And Inheritance Tax Taxation

There S A Tricky Virtual Currency Question On Your Tax Return

Uk Residential Property New Capital Gains Tax Rules Lexology

How Are Capital Gains Taxed Tax Policy Center

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate